Our Approach

Mission Statement

To deliver a superior wealth management experience with a deep commitment to doing business right – more importantly – doing right by all of our clients and honoring the trust they have instilled in us.

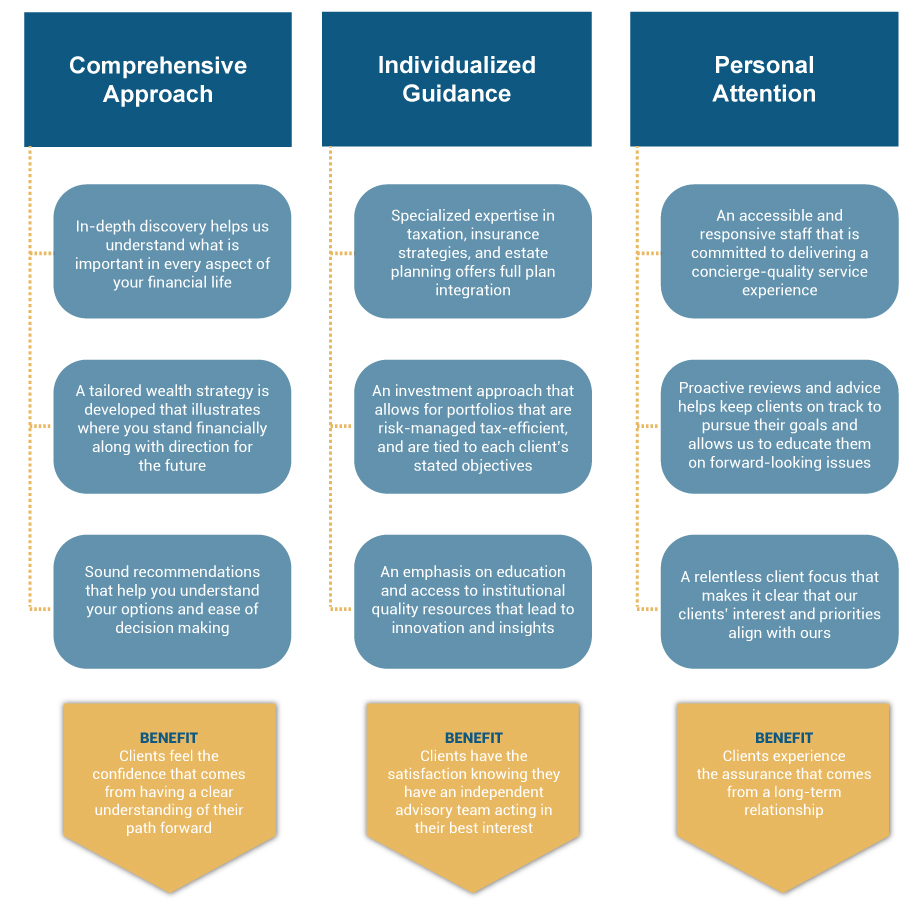

Our commitment to this mission is defined by three core principles:

Our Process

-

Step One: Before investing, we gain a clear understanding of a client's individual goals and current financial state with an initial meeting.

- Step Two: After speaking thoroughly, only then do we customize a tax efficient investment portfolio that tries to meet our client's specific needs.

- Step Three: Cross-checking Portfolio Risk and Return, using third party, in-house analysis

- Step Four: Review/Fine Tune with Client and produce a final written investment strategy that is agreed upon prior to investing

Our Compensation

Fee-based Fiduciary

Deptola & Associates operates under a fee-based fiduciary model, which means we have committed to a legal obligation to place our client’s interest above our own. We chose this structure because we live by the idea that building and protecting wealth requires commitment and good faith practices.

To mitigate possible conflicts of interest, we compensate our employees with a yearly salary rather than a commission-based pay system. Their earnings are not dependent on sales transactions, and they need not rely on a list of vendors provided by our broker-dealer. When choosing investments, we don’t prioritize sales quotas or the interests of any bank, mutual fund, or insurance company.

Instead, Deptola & Associates provides superior guidance using a customized, balanced approach to investing. While we cannot control the ups and downs of the market, we can work to safeguard client assets by diversifying investments across top-tier companies. We take great care to work only with firms that reflect our high standards and offer the best solutions to build and rebalance custom client portfolios. This comprehensive due diligence research ensures that our clients have the most appropriate investments for their specific financial goals and objectives.

As fee-based advisors, our compensation is contingent upon the services we provide. Our earnings increase or decrease in accordance with your portfolio’s success, so delivering a superior wealth management experience is in our mutual best interest.

A culture of excellence, based on unchanging core values of integrity, innovation and honesty.

That’s the Deptola Difference.